Align

An equity crowdfunding platform for startups and investors

Client

DESIGNATION

Role

UX

Date

JAN 2016

Tools

Sketch, Invision, POP

The Brief

In this DESIGNATION exploratory project, I worked with a team of designers to develop an equity crowdfunding platform for startups and investors. During a three-week Google Design Sprint I was a UX designer on a team of four where I was responsible for user research, usability testing, and wireframes.

In May 2016, the U.S. Securities and Exchange Commission recently voted to approve Title lll, which allowed the sale of securities through online equity crowdfunding. The new rules allow small and medium-sized start-ups to raise capital for their enterprises by offering equity to anyone, rich or poor, accredited or unaccredited. The challenge was to create an equity crowdfunding platform that entices both startups and investors.

Empathize and Defining The Problem

Defining the Research Goals

Building an equity crowdfunding platform meant that we had to consider the perspectives of both investors and startups when making an investment. Since Title lll was not set to pass until May 2016, our team first performed domain research to fully understand the constraints of the legislation as well as finding possible opportunities. Along with a competitive analysis, our team defined the goals of our research to 3 main points:

Understand motives and incentives that influence investors’ decision making process

Explore inefficiencies and pain points in people’s investment process

Understand the relationship between startups and investors

Qualitative Data

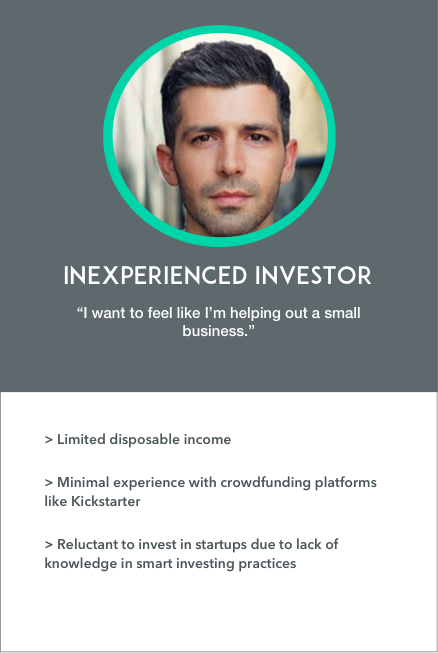

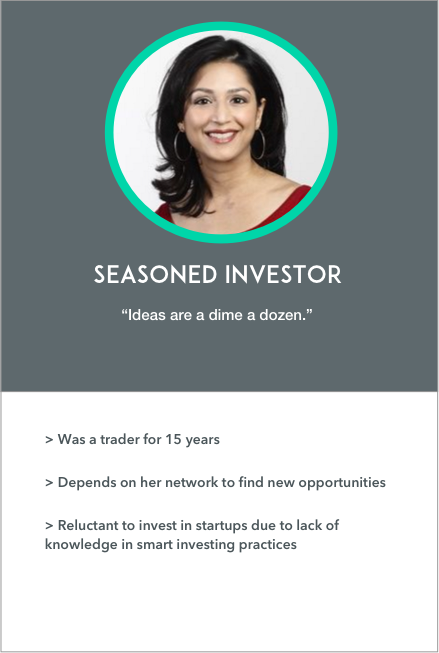

We conducted user interviews with 8 investors and 5 startups in person and over the phone. Each interview lasted roughly 15-20 minutes and consisted of detailed questions to the startups and investors about their investing experience. For the investor interviews, we identified that there were two distinct types of investors: the experienced investor who participated in multiple investments for years and the inexperienced investor who was new to investing and participated in fewer and smaller investments. This was important to identify because both types have very different needs and wants when it comes to finding their new investment opportunities. In the startup interviews, we gathered insight from subject matter experts and startups that were currently in the works for a series A investment.

Key Takeaways

Experienced Investor Insights

"I invest in the team. Ideas get people emotional"

Invested in companies that don’t need their money, but value their partnership

Turned off by high risk and lower reward potential of crowdfunding

Considered the quality of the team as a major success factor

Startup Insights

"I don't want to lose control of my company"

Doesn’t want to lose control of their company to VC’s who demand a large percentage

Hates lengthy VC contracts

Gets frustrated by inconsistent timelines

Goes through an extensive process to try and attract investors

Inexperienced Investor Insights

"I want to feel like I'm a partof something"

Intimidated by investing

Evaluated companies based on personal opinions and beliefs rather than data due to the lack of investing knowledge

Wanted to feel like they’re helping the business

Needed to buy into the idea

During user interviews, we learned that startups have a hard time dealing with angel investors and venture capitalists who want a large stake of their company. As a result, they would rather look for ways to gain capital that wouldn’t dilute their business. The two types of investors, experienced and inexperienced, used different methods for vetting startups. The more experienced investor required a financial background, work history, and business plan while the inexperienced investor required to be convinced that the idea and the story of the company was big enough. Armed with these insights, our team realized that there were distinct features that needed to be considered for the final product to satisfy the needs of both types of investors.

Quantitative Data

In addition to user interviews, we received over 70 responses from people by sending a survey through various social media platforms and other outlets asking people about their investing practices. Based on the survey, we found that inexperienced investors used friends and family to find new investment prospects, didn’t need a lot of domain research, and were mainly interested in the story of the company's founders and their journey.

Key Takeaways

of inexperienced investors said that they did not need domain expertise

expected an ROI of 6%-10%

relied on family and friends to find new investment opportunities

This survey reaffirmed the insights we got from user interviews, confirming that inexperienced investors didn’t require the same amount of paperwork as experienced investors. We realized that this type of investor is more motivated by an idea or culture of a startup rather than the startup’s business plan or financial background.

Synthesizing

Using affinity mapping, we organized the raw data, which allowed us to identify patterns and similar behaviors in our research. We realized there was a two sided market for the equity crowdfunding platform and from a supply and demand perspective we knew that there was a large number of startups looking for investors vs. investors looking for startups.Because of this realization and the time constraints of our sprint, our team made the decision to focus our scope on making a platform that focused on investors.

Who we're designing for

After synthesizing the data, we created two investor personas. Each persona varied in investing experience, as a result, they required very different pieces of information in order to make their final decision.

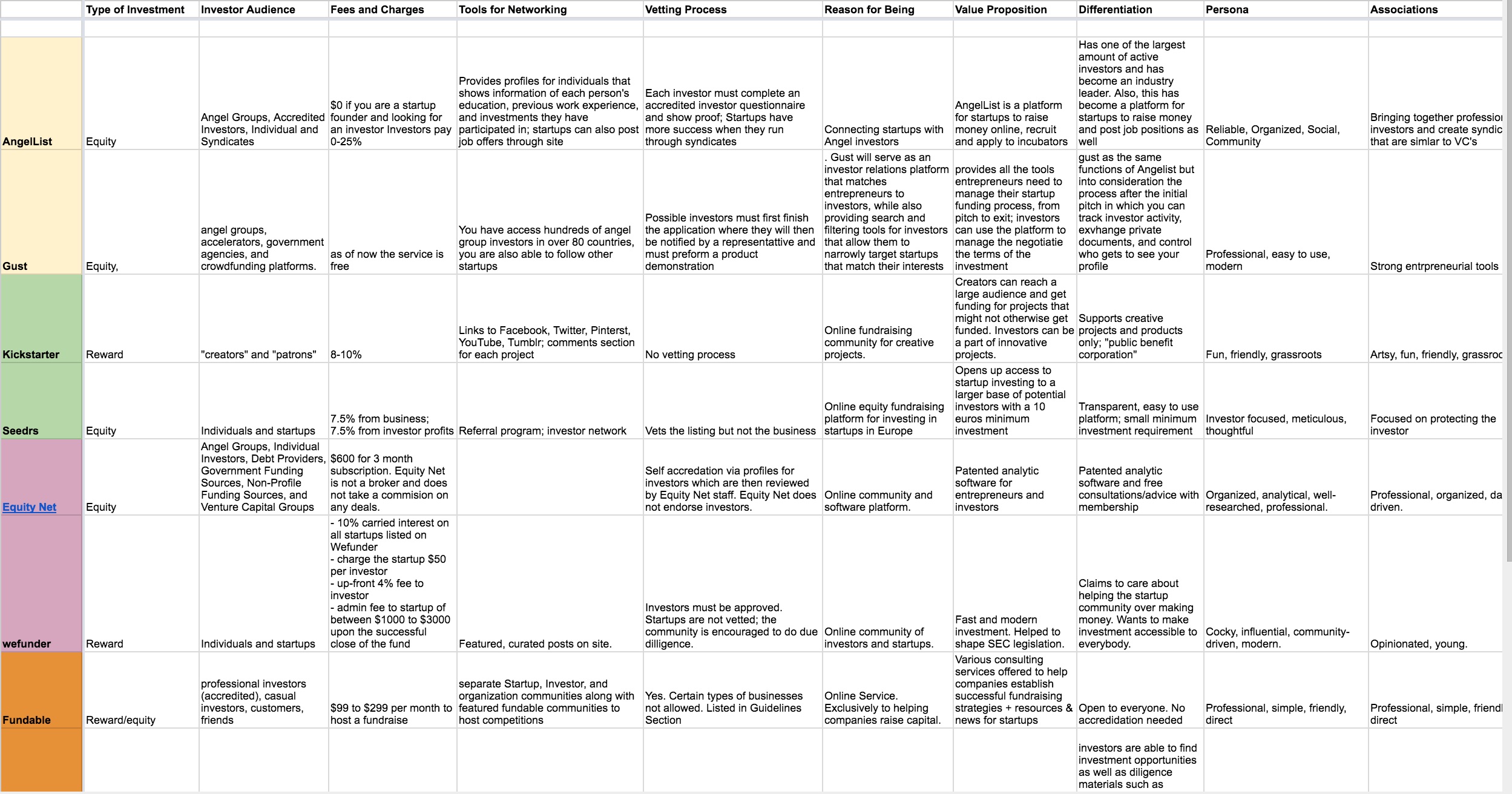

After formulating the personas, we performed a competitive analysis to identify what was currently available to investors and opportunities to develop new offerings.

Competitive Analysis

At the time of this project, there were only a few sites that offered equity crowdfunding. Our team performed a competitive analysis to see what current websites were available to investors and a SWOT analysis to expose opportunities within the industry. When our team examined the competitive landscape, we decided to focus on popular crowdfunding websites like Kickstarter and top investment websites like Circle Up and Seedrs. We categorized competitors based on whether they catered to accredited or non-accredited investors and the type of reward given.

Though Kickstarter only participated in crowdfunding for monetary donations, they had the largest active user base that was similar to our inexperienced investor persona. Observing their current model helped us develop the final product. The largest competitors, CircleUp and Seedrs, were the only websites offering equity crowdfunding. However, CircleUp only allowed accredited investors to find new opportunities and Seedrs only allowed investments in the UK. By analyzing the gaps in the competitions’ offerings, we determined a niche in the investment space for a platform that specializes in offering equity to for non-accredited investors.

Problem Statement

Young professionals want a way to invest their spare income confidently in opportunities that have the potential to benefit society and generate social and financial gains.

Design Principles

Confident: Should promote independent albeit well-informed decision making.

Selective: Investment opportunities must be a highly curated selection of opportunities.

Contemporary: Convey relevance and authority through clean, modern design.

Inclusive: Help users to feel like they’re a part of the businesses they’re investing in, and the communities they are trying to benefit.

Trustworthy: Transparent information and interactions between the platform and its users.

Informative: Educate users about opportunities across the platform

Approachable: Simple, easy-to-use design will make investing less intimidating and minimize stress.

Ideation and Prototyping

Sketching and Wireframes

Keeping in mind the design principles, personas, and the problem statement each member of our team separately sketched possible concepts. While generating each concept, we kept running into the question of: Does the user value investing for profit or investing for community more? After generating a few ideas, we presented them to one another to vote on which ideas we liked best, which then informed the design for our low-fidelity wireframes. The two strongest concepts were:

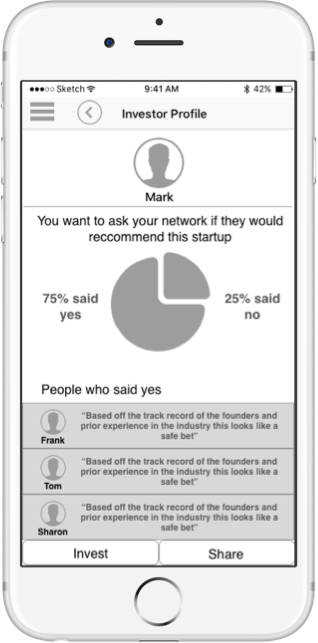

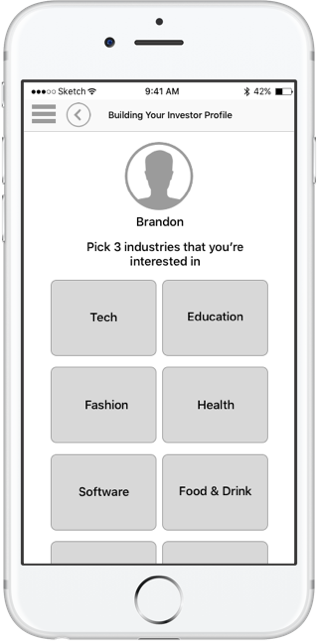

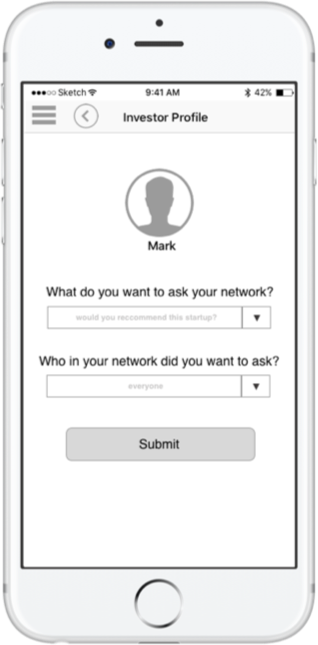

Concept #1 - Mobile App

A mobile app that focused on investors community and network.

Gave users the means to find new investment opportunities by asking people in their network to vet a business

Investors were also able to follow top investors and see their activity

Concept #2 -Web Platform

A website focused on startups in social impact

Users find new investment opportunities through discoverability

Gain investor trust through a lengthy vetting process for startups

Concept Validation Testing

To test both concepts, we had five users use the low-fidelity wireframes and perform a few tasks. Each concept had its strengths and weaknesses that gave us important insights on what users were looking for in the investment process.

Mobile App Insights

“I don’t feel comfortable making large investments on my phone”

Users felt that there was a lack of information about each startup

Most subjects said that they would not make an investment on a mobile app

The majority of users liked the idea of following a top investor and seeing their activity

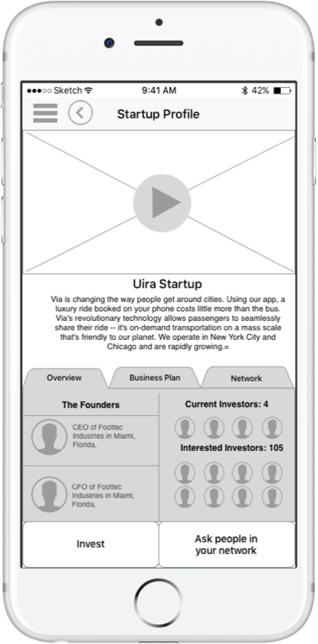

Web App Insights

“It would be nice to see who else is investing in the startup”

Most of the test subjects felt safer making investments on a website platform over a mobile app

Even though users were given a large amount of info about each startup, they still wanted to know who the other investors were.

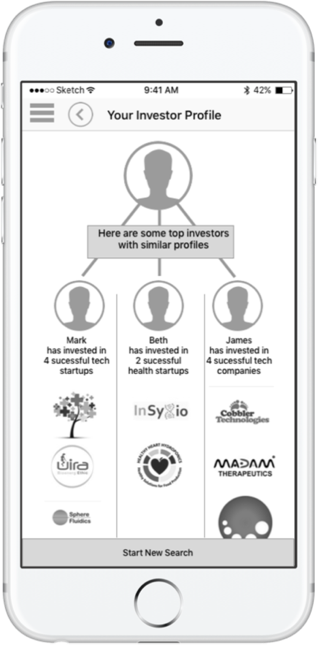

After running the tests, users felt they would be more likely to use the website over the mobile app to make an investment. With this insight, we developed the mid-fidelity wireframes for a website as our final product and incorporated social features from the mobile app.

The Product

Introducing: Align

An equity crowdfunding platform connecting inexperienced investors to social enterprise startups. Align provides investors with necessary tools and resources to make confident investment decisions

The name Align came from the concept that we match potential investors with startups that share the same goals and values.

How the platform works:

Strict application process

Easily find and filter startups

View allocation of funds, business plans, team members

Communicate openly with investors and startup founders

View who else has bought into a particular company

Connect with and follow experienced investors

View and manage current investments

Further Considerations

Because of the time constraints of the Google Design Sprint, our team wasn’t able fully develop certain concepts. If I were able to further work on the project, there are several improvements I’d like to consider.

Further usability testing and refinement

Integrate more social and community tools in the website page

Fully develop mobile app of the website